India’s passenger vehicle (PV) industry maintained steady growth in September 2025, with total retail sales reaching 2,99,369 units, up from 2,82,945 units a year earlier.

This translates to a 5.8% year-on-year increase, underscoring strong consumer sentiment, robust SUV demand, and rising EV adoption, according to data from the Federation of Automobile Dealers Associations (FADA).

FADA compiled the figures from 1,392 RTOs (out of 1,458), excluding Telangana.

The growth momentum was largely driven by a late-month sales surge, following the GST 2.0 rate adjustments and the onset of the Navratri festive season, marking one of the best retail performances on record.

Top Performers: Market Leaders

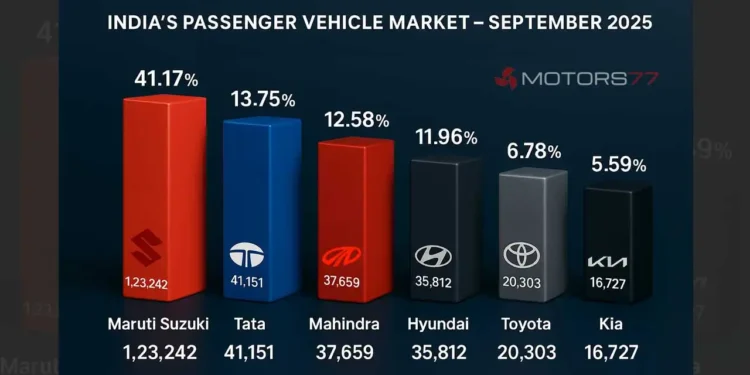

| OEM | Sep’25 Sales | Market Share (Sep’25) | Sep’24 Sales | Market Share (Sep’24) |

|---|---|---|---|---|

| Maruti Suzuki India Ltd | 1,23,242 | 41.17% | 1,15,530 | 40.83% |

| Tata Motors Ltd | 41,151 | 13.75% | 32,586 | 11.52% |

| Mahindra & Mahindra Ltd | 37,659 | 12.58% | 35,863 | 12.67% |

| Hyundai Motor India Ltd | 35,812 | 11.96% | 38,833 | 13.72% |

| Toyota Kirloskar Motor Pvt Ltd | 20,303 | 6.78% | 20,792 | 7.35% |

| Kia India Pvt Ltd | 16,727 | 5.59% | 16,062 | 5.68% |

Analysis: The Top Six

- Maruti Suzuki strengthened its dominance with a 41.17% market share, driven by steady demand for the Brezza, Fronx, and Grand Vitara.

- Tata Motors achieved a remarkable 26% YoY growth, its highest-ever share at 13.75%, led by SUVs (Punch, Nexon, Harrier) and EV success (Tiago EV, Nexon EV).

- Mahindra held firm at 12.58%, propelled by the Scorpio-N, Thar, and XUV700.

- Hyundai slipped to 11.96%, losing some ground to domestic rivals.

- Toyota remained stable, supported by hybrid demand from the Innova Hycross and Hyryder.

- Kia maintained consistency with strong Seltos and Sonet sales.

Notable Developments

| OEM / Group | Sep’25 Sales | Market Share (Sep’25) | Sep’24 Sales | Market Share (Sep’24) |

|---|---|---|---|---|

| Skoda Auto Volkswagen Group | 6,510 | 2.17% | 5,460 | 1.93% |

| Skoda Auto Volkswagen India Pvt Ltd | 6,453 | 2.16% | 5,411 | 1.91% |

| – Volkswagen AG / India Pvt Ltd | 28 | 0.01% | – | – |

| – Audi AG | 23 | 0.01% | 41 | 0.01% |

| – Skoda Auto India / AS Pvt Ltd | 6 | 0.00% | 8 | 0.00% |

| JSW MG Motor India Pvt Ltd | 4,729 | 1.58% | 3,069 | 1.08% |

| Honda Cars India Ltd | 3,340 | 1.12% | 4,029 | 1.42% |

| Renault India Pvt Ltd | 2,517 | 0.84% | 2,741 | 0.97% |

| Nissan Motor India Pvt Ltd | 1,319 | 0.44% | 2,171 | 0.77% |

Analysis: Growth Stories and Struggles

- Skoda-Volkswagen Group improved its market share to 2.17%, buoyed by the Kushaq, Slavia, and Virtus.

- JSW MG Motor grew 46% YoY, highlighting strong traction for the Comet EV and Hector after its JV restructuring.

- Honda declined to 1.12%, constrained by a limited SUV lineup.

- Renault and Nissan continued to face headwinds due to outdated product portfolios.

Premium and Luxury Segment

| Brand | Sep’25 Units | Market Share | Sep’24 Units | Market Share (Sep’24) |

|---|---|---|---|---|

| BMW India Pvt Ltd | 1,209 | 0.40% | 1,086 | 0.38% |

| Mercedes-Benz Group | 1,182 | 0.39% | 1,377 | 0.49% |

| – Mercedes-Benz India Pvt Ltd | 1,055 | 0.35% | 1,233 | 0.44% |

| – Mercedes-Benz AG | 94 | 0.03% | 135 | 0.05% |

| – Daimler AG | 33 | 0.01% | 9 | 0.00% |

| Jaguar Land Rover India Ltd | 475 | 0.16% | 487 | 0.17% |

Luxury Segment Insights

The luxury segment displayed mixed results:

- BMW overtook Mercedes-Benz, driven by X1 and 3-Series Gran Limousine demand.

- Mercedes volumes fell slightly due to model updates and supply issues.

- JLR stayed steady with demand for the Defender and Range Rover Velar.

Luxury remains a niche yet resilient segment, comprising ~1% of India’s PV market.

Emerging & Other Players

| OEM | Sep’25 Sales | Market Share | Sep’24 Sales | Market Share (Sep’24) |

|---|---|---|---|---|

| BYD India Pvt Ltd | 547 | 0.18% | 176 | 0.06% |

| Force Motors Ltd | 598 | 0.20% | 555 | 0.20% |

| PCA Automobiles India Pvt Ltd | 372 | 0.12% | 677 | 0.24% |

| Others | 1,677 | 0.56% | 1,451 | 0.51% |

| Total | 2,99,369 | 100% | 2,82,945 | 100% |

Analysis: Rising Niches

- BYD India tripled its sales YoY, led by the Atto 3 and Seal EV.

- Force Motors maintained steady performance with its Gurkha SUV.

- Citroën (PCA) continues to face market traction challenges.

- “Others” — including Volvo, Lexus, and Mini — together account for 0.56% share.

Key Insights & Market Dynamics

1. SUV Demand Dominates

Over 50% of all PVs sold were SUVs.

Tata, Mahindra, and Hyundai lead the charge, while Maruti rapidly expands its SUV lineup.

2. EV & Hybrid Surge

Tata Motors leads in EV volume; Toyota and Maruti dominate hybrids.

Strong growth for BYD and MG confirms accelerating urban EV adoption in the ₹15–30 lakh range.

3. Competitive Realignment

Indian OEMs are outpacing traditional Korean and Japanese rivals.

Tata’s EV leadership and Mahindra’s SUV resurgence signal a shift in consumer trust.

4. Market Concentration

Top 3 players (Maruti, Tata, Mahindra) now hold nearly 67% market share — a strong indicator of brand loyalty and distribution dominance.

5. Inventory & Seasonal Outlook

Dealer inventories stand at ~60 days, indicating high festive readiness.

Strong Dussehra-Diwali demand could push FY26 PV retail sales near the 4-million-unit mark, a record milestone.

Outlook: October–November 2025

- The festive quarter will be crucial for clearing inventories and meeting hybrid-EV demand.

- Expect double-digit MoM growth in October due to Dussehra-Diwali momentum.

- The SUV-EV mix will continue to shape the market.

- Stable interest rates, GST incentives, and new launches (like Nissan’s new C-SUV and Tata Sierra EV) will drive growth into FY26.